Working as One Survey

Executive Summary

Collaboration is good for business, and the UK’s net zero goals will empower and enable more collaboration, and at a faster pace. As organisations continue to navigate their way through a challenging operating environment, new and existing collaborative behaviours will be vital not only for tackling the difficulties of today but also the opportunities of tomorrow. For example, collaborative capabilities across the supply chain will allow the decarbonisation of present and future business activity through technology. This will make energy supply more sustainable.

OEUK has created a new survey, the Working as One survey, to examine collaboration right across our sector and adherence to the OEUK Supply Chain Principles. It has helped to gather good data on what’s working, and what’s not, in terms of collaboration between operators and supply chain companies, and between supply chain companies.

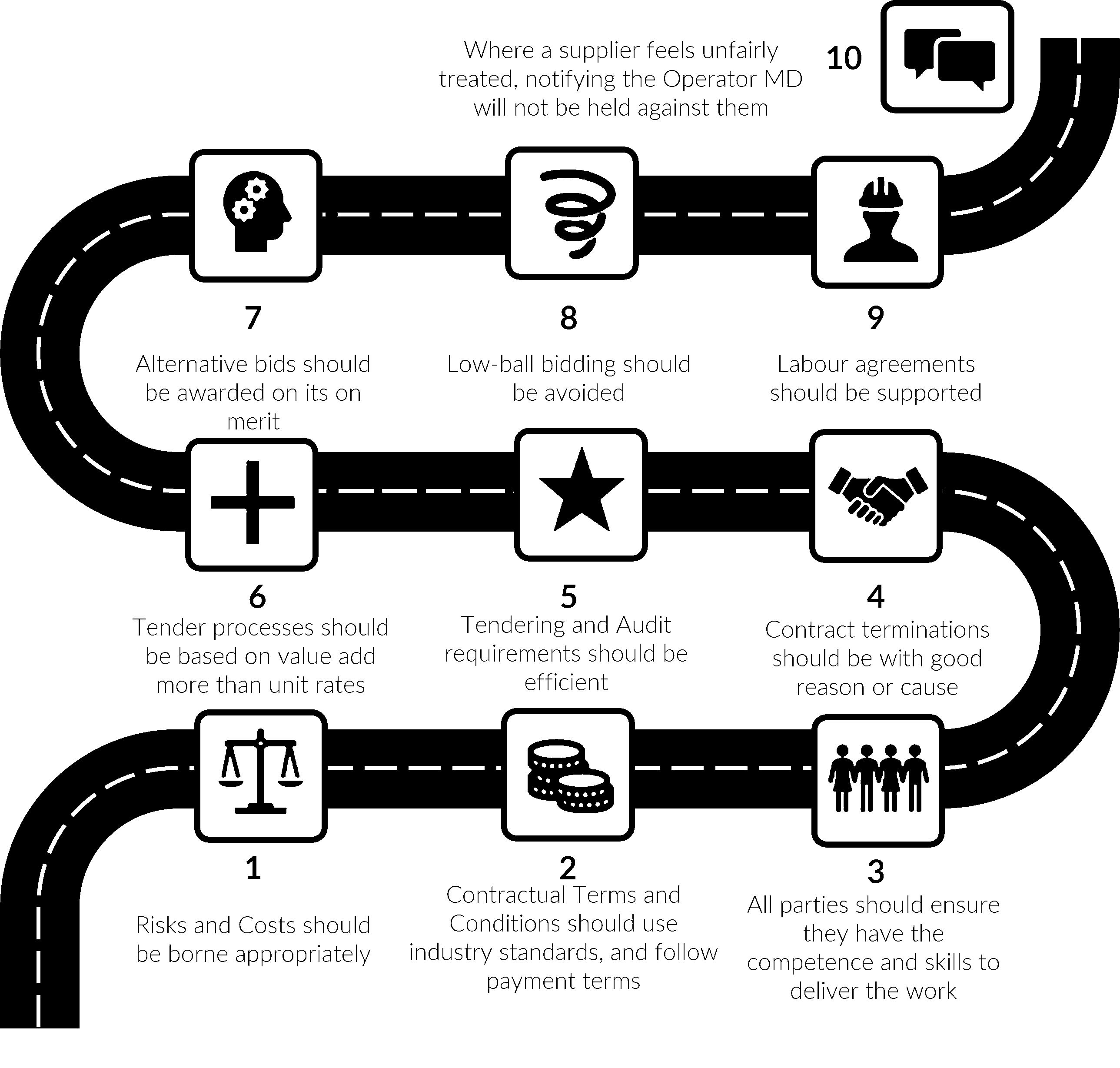

Launched in 2019, OEUK’s Supply Chain Principles are a key part of our sector’s recovery through the correction of negative commercial behaviours. The OEUK Supply Chain Principles offer a powerful solution to not only increase supply chain resilience but also maximise its potential as well as utilise its experience, innovative ideas and technologies to bolster activity in the UKCS. The Principles define good practices that enable industry to achieve a sustainable green recovery while helping to eliminate negative business behaviours. These insights will help to harness good practices, learn from industry and drive improvements in 2022 and beyond.

Introduction to Working as One survey

OEUK and Deloitte have been successfully collaborating on the UKCS Collaboration report since 2016, each year working together to share with industry how our collaborative culture is changing. However, with the Collaboration Index plateauing for several years member feedback has highlighted the need for new insight, and to support the drive for greater support for the Supply Chain Principles from the whole sector by measuring adherence in a quantitative, systematic way. Furthermore, whilst the 2020 survey participants represent 80% of UKCS activity, providing a good cross-section insight into industry collaboration, member feedback has shown a need to open participation to both operators and the full supply chain.

OEUK’s new ‘Working as One’ survey is focused on the ten supply chain principles and has has four sections;

1. Reasons to collaborate – examining the main drivers for collaboration

2. Energy Transition – important to understand how companies are working together to adapt to a changing regulatory and societal environment

3. Existing tools – understanding what industry uses already

4. Supply chain principles – breaking down every principle into two or three questions, we are able to measure adherence and identify opportunities to focus efforts

OEUK commissioned a third party company, Astrimar, to conduct the survey to ensure the results were free from any bias. Although Astrimar managed the operation of the survey, as in previous years the responses were anonymous to encourage companies to take part. As in past surveys, we ensured participants could receive constructive feedback anonymously – giving sight to blind spots within their relationships. All the results were then fed back to participants anonymously from their own supply chain.

This webpage details the main findings from our survey – the interactive PowerBI dashboard below can be sliced per company size for finer resolution.

The report from Astrimar detailing the data process and results can be downloaded here.

What’s new?

Building on the success of previous Collaboration reports, this Working as One survey has introduced some new elements ;

Examining wider collaboration: Broadening survey participation to the full supply chain has enabled us to measure intra-supply chain collaboration. This was achieved by inviting Tier 1 companies to participate and send their survey to their supply chain and this for the first time gave us insight into how supply-chain companies interact.

Supply Chain Principles: OEUK’s ten supply chain principles define what good, sustainable procurement practice looks like looks like and so add value and boost business competitiveness. The survey explores each principle one by one, and the extent to which participating companies are putting them into practice

Accessing live data: working with Astrimar, we were able to grant participants full access to their results as they came in. Companies could thus see how they were performing and benefit from immediate and direct feedback.

Ranking participants: Astrimar and OEUK ranked each participant against its peers in terms of the supply chain principles. Using Asset Stewardship data from 2021, we grouped each participant by size, to allow a meaningful comparison. While all companies are anonymous, those receiving individual reports will be able to see their own score.

Demographics

This survey was live from September 2021 – December 2021. Results were analysed in Jan 2022 and released to OEUK members in Feb 2022.

58 companies participated in the survey, giving 426 responses in all. The participants represent

22 operators

16 Tier 1

20 Tier 2/SME

Using UKCS Asset Stewardship data we know that the companies participating represent 98% of activity in the basin.

In signing up for the survey, we asked those participating to say where they saw themselves: Operator, Tier 1, Tier 2 or small or medium enterprise (SME). They picked the category they belonged to. It was on this basis that we analysed the data.

Key Findings

Only companies who received more than five responses qualified for feedback, in order to ensure the anonymity of respondents. The information below is based on the full set of 426 responses in order to allow us to analyse and identify key findings.

Our key findings are;

Reducing Risk is more important than Reducing cost. For the first time in our survey’s history, risk reduction was voted as more important than reducing cost when it comes to collaborating. Tier 1 and Tier 2/SME participants overwhelmingly voted for this while cost reduction came in third place. Operators continued to vote cost reduction as their primary reason to collaborate, but the supply chain weighted risk reduction consistently higher. Improved delivery and performance were the primary reasons for collaboration.

Intra-supply chain collaboration is more evident than operator-supply chain collaboration. That is, Tier 1 companies collaborate more closely with other Tier 1 or Tier 2/SME companies than operators collaborate with the principles. This can be seen in:

- Supply chain principles adherence: 36% of Tier 1 suppliers always adhere to the principles while only 22% of operators always adhere to the principles

- Operator feedback shows that 40% of them always review their commercial relationships and are committed to continuous improvement with partners. By comparison, more than 60% of Tier 1-2/SME are committed to driving continuous improvements in their business relationships

- Effective and open communication between both parties through the contract management process is much stronger in Tier 1-2/SME, compared with operators

- During the contract performance, half of Tier 1 supply chain companies strongly agree that requirements are met appropriately, while only a quarter of operators strongly agreed.

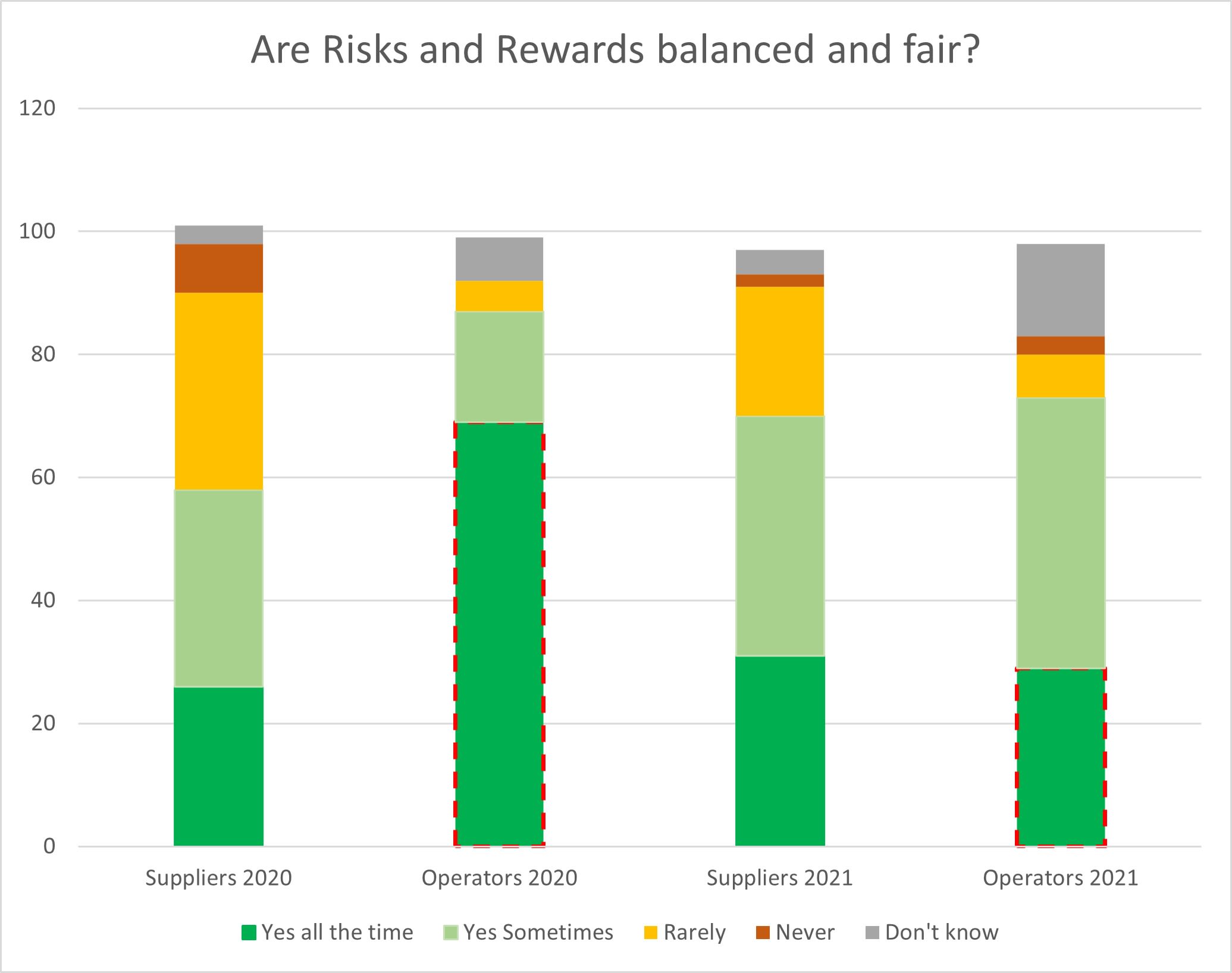

Better understanding of the challenges: In 2020 we found a considerable gap between how suppliers and operators view contracts. A much larger proportion of the latter thought that contracts were a fair reflection of risk and reward. Our 2021 survey has shown this gap has significantly reduced, and operators and suppliers have aligned in their opinions.

‘We have a plan to convert to green energy but need better margins to execute it’

‘We are preparing our own energy transition plans and have had no engagement across our partners about emission reduction. All our collaboration efforts are focused on cost reduction’.

‘We are still figuring out where we can fit into the energy transition’

‘There has been a lot of talk but only some action. More action is needed’

'The Supply Chain is used to collaborating ; the operators need to as well'

Just over four in every five (83%) suppliers (Tier1 and Tier2/SME combined) either strongly agree or agree that potential risks and rewards are objectively discussed and evaluated before the start of the contract. Once it was operational, they felt they were shared proportionately. This compares with 81% of Operators. This represents a significant narrowing of the gap in opinions about how they view risk and reward compared with the year before (but that was an exceptional year!).

The Supply Chain wants to innovate. In examining collaboration within the “energy transition” section of the survey, free-text data revealed that Tier2/SME companies have technologies and ideas they want to share but that they struggle to do so. A third (33%) of Operators strongly agree that innovation is actively sought out and encouraged, whereas only a sixth (16%) Tier 2/SME believe this is the case.

Collaboration in Energy Transition: our data revealed that over three quarters of the responses have a plan in place for the Energy Transition with their partners. There is also a 10% improvement in sentiment since 2020 on the progress they have made against their energy transition objectives. In 2020 13% reported they were making great progress, while in 2021 this percentage had risen to 23%. While 41% reported making some progress in 2020, in 2021 this increased to 50%.

In 2021 we have seen 92% working collaboratively with their partners to reduce emissions, compared to 78% in 2020.

Supply Chain Principles – measuring adherence

This survey examines adherence to OEUK’s ten supply chain principles, and awareness of these has increased by 22%. Over the last year, suppliers (Tier 1 in particular) have embraced the supply chain principles more than operators. Throughout 2021, OEUK has been focusing efforts in three areas related to the principles – Risk and Reward, Innovative Ways of Working and Payment Performance. The effort in 2021 is paying dividends as demonstrated in the improvements in feedback brought out in the survey.

Risk and Reward TFG Objective: The objective of this Task Finish Group is to develop commercial best practice within the Procurement & Supply Cycle for the UK Continental Shelf, whereby ‘risk’ and ‘cost’ are borne appropriately and are proportional to the work scopes, while opportunity or good performance should benefit all parties.

Risk and Reward Feedback - Our data tells a positive story overall, with more than 70% agreeing that risks and rewards are objectively discussed and evaluated before the start of the contract. The themes in the free text feedback highlight that it has become normal to make the supply chain bear the risk and smaller companies are refusing to tender if the risk is too unbalanced. Short-term costs are given more weight than long term value. Where risk is shared, there is ‘more stick than carrot’. The data tells us that smaller Tier2/SME companies ‘do as they are told’ in contracting as they do not have resources to do anything else.

Payment Performance TFG Objective:

To develop and share best in class business process associated with payment performance. This is intended to include each of the following, as a minimum:

- Validation of Accounts Payable (AP) process

- Review of buyer terms and conditions

- Review of onboarding process when a new supplier appointed

- Review of invoice dispute resolution process

- Role of payment performance KPIs for buyer and seller’

Payment Performance Feedback: The survey revealed a mixed response to adhering to this principle. In examining when payments are made, 44% are always paid per their agreed terms and 45% sometimes are. Positively, industry-standard contacts are used more than 70% of the time. Three quarters (75%) of those who responded had standard payment terms of 30 days; 16% had 60 days and 3% had 90 days (with 6% not knowing). Feedback from 2020 told us that Tier/2 SME companies struggle more than larger companies with delayed payments. Our survey in 2021 revealed that only 32% expedite payments to SMEs, and over 65% don’t know, or don’t at all. Overall, we were told that payments are generally made within the timescale agreed but the pre-invoice stage is the biggest barrier to getting paid owing to complex systems. We saw evidence of operators making changes to standard contracts unnecessarily as a symptom of ‘it’s always been done this way’, highlighting a key behaviour change is needed.

Innovative Ways of Working TFG Objective:

The objective of this Task Finish Group is to embed (or champion) innovative ways for working into Procurement & Supply Cycle by ensuring that tender processes and their evaluation are based on value added rather than fixed rates while encouraging flexibility to consider alternative offers as part of any bidding process.

Innovative Ways of Working Feedback: Industry’s approach toward this principle is encouraging yet there is scope for improvement. Positively, over 80% always or regularly request/provide new ideas within the tendering process. These results provide initial confidence that the industry is routinely looking for alternative ways to create value.

Key Actions

OEUK is already in action, and will continue to focus on the three core principles through the Supply Chain Forum. OEUK acted on the feedback from the 2020 Collaboration report and anecdotal feedback to focus efforts on three areas, and reassuringly the 2021 data here shows a real improvement. Our three task finish groups (TFGs) will continue to use the data from this survey to drive efforts.

If you would like to participate in any of these work areas, please contact the Supply Chain and Operations team ; oeuksupplychainandoperations@OEUK.org.uk

Working as One – Full survey results

The PowerBI dashboard below contains the full Working as One survey data. Users can click through the different sections of the data and slice per industry segment.